Day Trading vs Swing Trading: Which Strategy Fits Your Financial Goals?

In today’s dynamic financial markets, choosing between day trading vs swing trading is a crucial decision that impacts your returns, stress levels, and lifestyle compatibility. At Market Nexus Edge, we empower traders with the education, tools, and expert support needed to thrive with either strategy.

This comprehensive guide walks you through the nuances of both trading approaches—so you can align your investment strategy with your goals, personality, and available resources

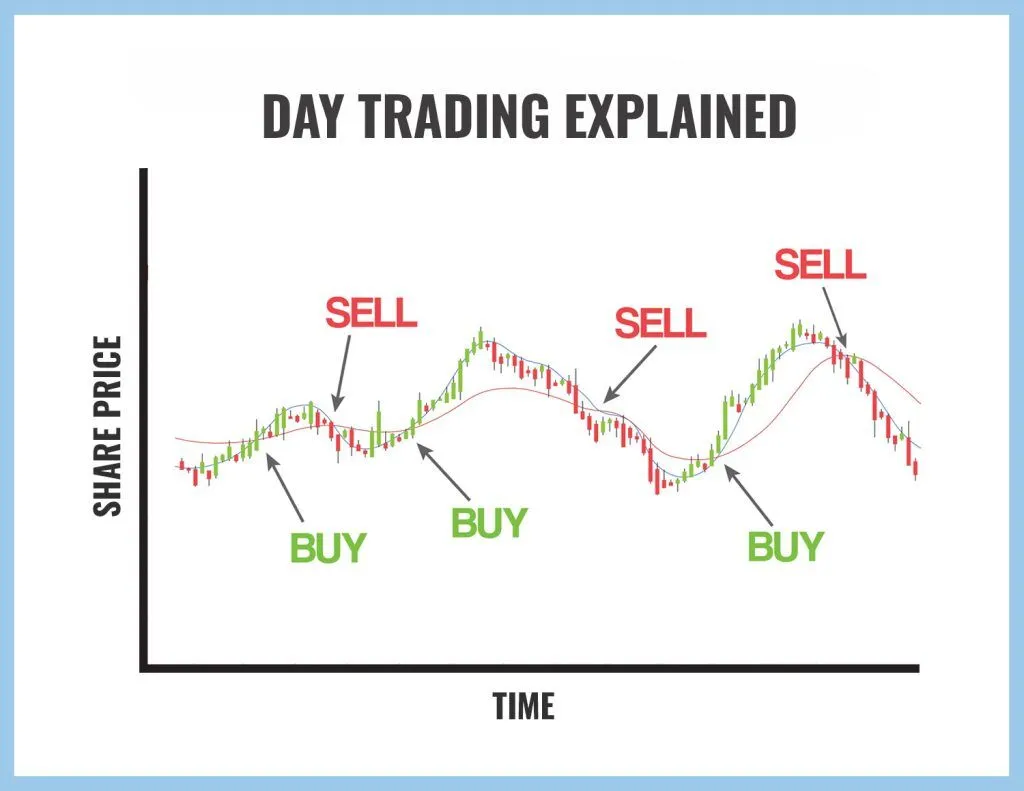

What Is Day Trading?

In day trading vs swing trading, Day trading is a short-term trading strategy where traders open and close positions within the same market session. The goal is to take advantage of small price movements multiple times a day, with no positions held overnight.

Key Characteristics:

Time-Sensitive: Trades are executed quickly—often within minutes or hours.

Tools Required: Advanced trading platforms, real-time charts, and low-latency execution.

Popular Strategies:

Scalping

Momentum trading

News-based setups

Day trading attracts traders who:

Can focus during full market hours

Have strong discipline and risk management skills

Thrive in fast-paced environments

Are ready to invest in high-end trading tools

Pros of Day Trading:

No overnight exposure

Instant trade feedback

Tight risk control

Scalable with algorithmic systems

Challenges of Day Trading:

High stress and mental fatigue

Advanced infrastructure requirements

Regulatory limits (e.g. pattern-day trading rules)

Demanding learning curve

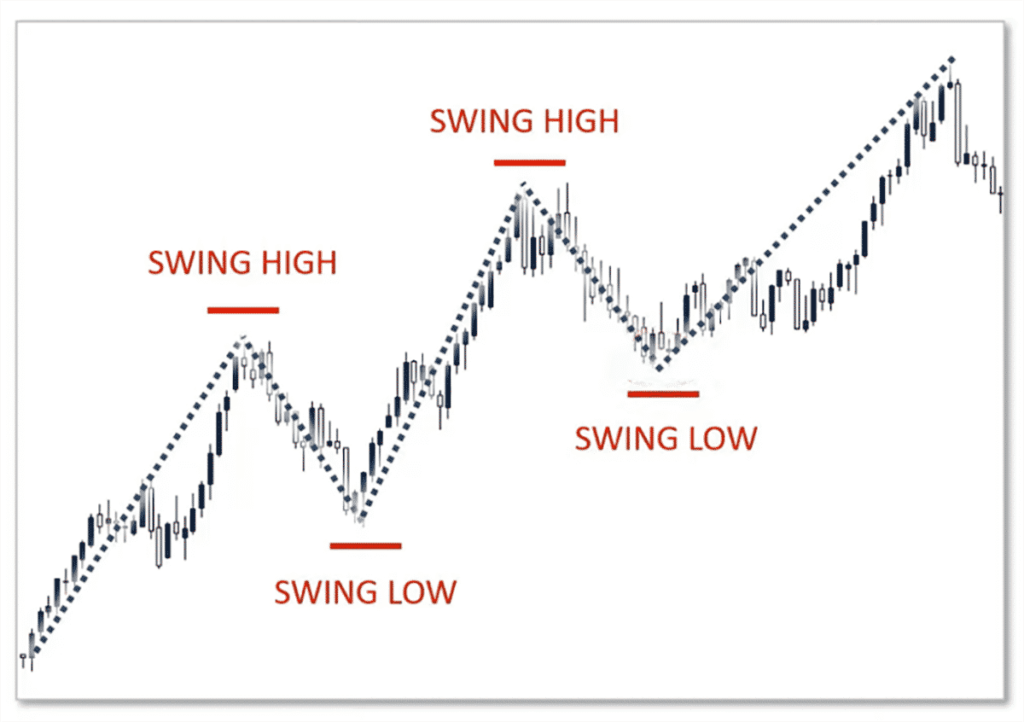

What Is Swing Trading?

In day trading vs swing trading , swing trading focuses on holding trades over several days to weeks to capture broader price movements. This approach suits those who can’t monitor markets constantly but still want to trade actively.

Key Characteristics:

Extended Duration: Hold times range from a few days to several weeks.

Analysis Mix: Combines technical chart analysis with key fundamentals.

Risk Control: Swing traders typically use wider stop-losses to manage risk from overnight volatility.

Who Is Best Suited for Swing Trading?

Swing trading benefits traders who:

Prefer a slower pace of decision-making

Have part-time availability

Seek larger returns per trade

Can handle overnight market risks

Pros of Swing Trading:

Flexibility to trade alongside other commitments

Reduced pressure and screen time

Opportunity to capture more significant price swings

Lower startup cost vs. day trading

Challenges of Swing Trading:

Exposure to news events and gaps

Longer learning cycles

Tied-up capital for extended periods

Day Trading vs Swing Trading: A Strategic Comparison

| Criteria | Day Trading | Swing Trading |

|---|---|---|

| Duration | Minutes to hours | Days to weeks |

| Frequency | Dozens of trades daily | 2–10 trades/month |

| Time Requirement | Full-time | Part-time |

| Setup Costs | High (platforms, data feeds) | Lower (basic brokerage) |

| Return Potential | Smaller per trade, frequent | Larger per trade, less frequent |

| Risk Exposure | Intraday volatility | Overnight and weekend gaps |

| Psychological Demand | High-pressure and fast-paced | Requires patience and resilience |

How to Choose the Right Trading Style

1. Consider Your Schedule

Do you have time during the day to monitor positions? If yes, day trading may suit you. If not, swing trading provides more flexibility.

2. Reflect on Your Emotional Strength

Day trading demands fast thinking and quick emotional recovery. Swing trading requires tolerance for slow-moving trades and patience with results.

3. Assess Your Tools & Capital

Day trading often needs higher investment in software and data. Swing trading can be started with a lower-cost setup.

4. Clarify Your Financial Goals

Do you prefer frequent, smaller returns or fewer trades with higher potential gains? Your income expectations can help you decide.

Getting Started with a Strategy

For Day Trading:

Choose a fast and reliable trading platform

Use demo accounts to practice execution

Follow a risk management plan with tight stop-losses

Maintain a trading journal for continuous improvement

For Swing Trading:

Use daily and weekly chart analysis tools

Backtest your setups before going live

Place stop-loss and take-profit targets logically

Review trades weekly and refine strategies

Avoid Common Mistakes

Day Trading Pitfalls:

Overtrading due to emotional triggers

Ignoring trading costs and slippage

Trading without a predefined plan

Swing Trading Pitfalls:

Not reacting to macroeconomic changes

Forgetting to move stop-loss orders

Holding unprofitable positions for too long

Combine Strategies With Copy Trading at Market Nexus Edge

At Market Nexus Edge, we offer more than just guidance—we offer action-ready solutions.

Use copy trading to:

Follow expert traders in both day and swing styles

Gain exposure to multiple strategies at once

Learn from professionals while practicing on your own

By mirroring seasoned traders, you accelerate your understanding and build confidence in real-time.

Final Thoughts: Strategy That Matches Your Style

Ultimately, the debate between day trading vs swing trading isn’t about which is better—it’s about which is better for you.

Your trading style should align with:

Your lifestyle

Your psychological strengths

Your capital capacity

Your long-term vision

At Market Nexus Edge, we help traders make informed decisions backed by education, community, and advanced tools. Whether you choose the fast lane or the scenic route, we’re here to help you trade smarter.

Ready to Get Started?

Explore our expert-curated trading signals

Learn through our dedicated educational platform

Join a global network of traders on the rise

Market Nexus Edge—Where Smart Traders Evolve.